A view on tax for Japan’s national sport by a British tax adviser – Sofia Thomas

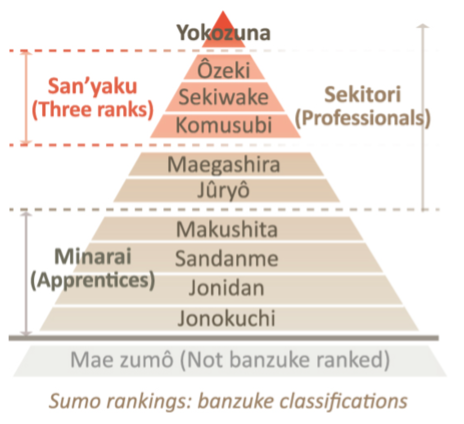

In January 2024, I was lucky enough to attend a Sumo tournament in Tokyo, Japan. The tournament last all day and start with the wrestlers lower down the Sumo pyramid and end with those at the top:

A few things that interested me as a sports tax adviser..

Cash winnings

🇯🇵 The winners of each bout are given a white envelop at the end of the fight with their winnings in. I couldn’t verify if this was for show or contained actual cash. What I could see was that the envelopes got larger as we went up the pyramid. If it is actual cash then each fighter will have a responsibility to declare the winnings and pay the appropriate amount of tax at the end of the tax year.

🇬🇧 In the UK when tournaments are hosted for combat sports, the organiser has a duty to withhold usually 20% tax before paying out any winnings and, in most cases, they would never be paid in cash at the event.

Tax free gifts

🇯🇵 Sumo wrestlers are exempt from tax on any gifts they receive from individuals. When I was reading about this I found it a pretty interesting distinction that is made. I spoke to our Japanese guide and Sumo super fan about it and she said that many Sumo wrestlers are gifted things from individuals and their community and this may be why there is a such clear distinction for this in the tax regime.

🇬🇧This is pretty similar to the position for athletes in the UK. Gifts are not taxable unless they are received by virtue of employment or the athlete is performing a service in return for the gift. This is becoming a more complex area. The complexity arises when athletes are gifted products and services by firms and then they post about this on their social media. The question becomes is this a barter transaction (find more on that in our member hub).

Communal living in sumo stables

🇯🇵 Sumo Wrestlers live in stables. There are 47 stables in Japan. The wrestlers who have not achieved higher status are not paid but they can live & train in the stables for free. Base salary is decided by rank. Yokozuna make about ¥2.8 million per month with juryo division wrestlers earning about ¥1 million per month.

🇬🇧 In the UK if your employer pays for housing this is usually a taxable benefit (meaning that the individual pays tax on the cash value of the rent). This is what we see when footballers stay with host families. However, when the accommodation is required as part of the job this can be a tax free benefit (for example vicars who live in vicarages).

Artistry & Tradition

🇯🇵 The whole experience of the day was phenomenal. There was a huge amount of tradition and artistry which sits alongside the actual wrestling. The pre match ceremony is almost as interesting as the bout itself.

🇬🇧 In the UK several years ago there was a call that wrestling should qualify for theatre tax relief as it is a performance and not a sport. It was argued that wrestling is ‘artistic’ and should benefit from the same funding as the other arts (read more about that here ‘it’s an art not a sport’).

Scandal

🇯🇵 As with most high profile national sports there have been a few tax scandals involving sumo wrestlers in Japan. The most notable dates back to the 90’s when the tax authorities investigated Takanohana the reigning “Yokozuna” (grand champion) for failing to report income of 68.7 million yen (around €420,000) from 1993 to 1995. In a short lived investigation Takanohana settled his taxes and fines and said in a statement “I was shown by national tax authorities how to correctly pay my taxes, and I will follow their recommendations from next year”.

🇬🇧 A huge sports tax case was recently settled in the UK against Formula 1 former owner Bernie Ecclestone. Mr Ecclestone had failed to report income from overseas on his UK tax returns. This led to a criminal investigation in the UK. Mr Ecclestone admitted tax fraud and agreed to pay over £600 million in taxes.

A brilliant day with a superb guide and it was great fun to think about taxes in the context of Sumo wrestling.

Sports Tax Advisor, Juno Sports Tax

Return to Knowledge Hub

Return to Knowledge Hub

The Latest

No Article 17 for Entertainers and Sportspersons in Proposed New Tax Treaty (Belgium - The Netherlands)Taxation of Sports Players at 2024 Euro Football & OlympicsFootball Tax Aware CourseIreland - A helping tax hand for retiring sports professionalsThe Belgian tax authorities as new referee in football