The International Sports Tax Association (ISTA) is pleased to announce the launch of a new resource focused on the tax impacts of the new FIFA Agent Regulations (FFAR) on the major European leagues.

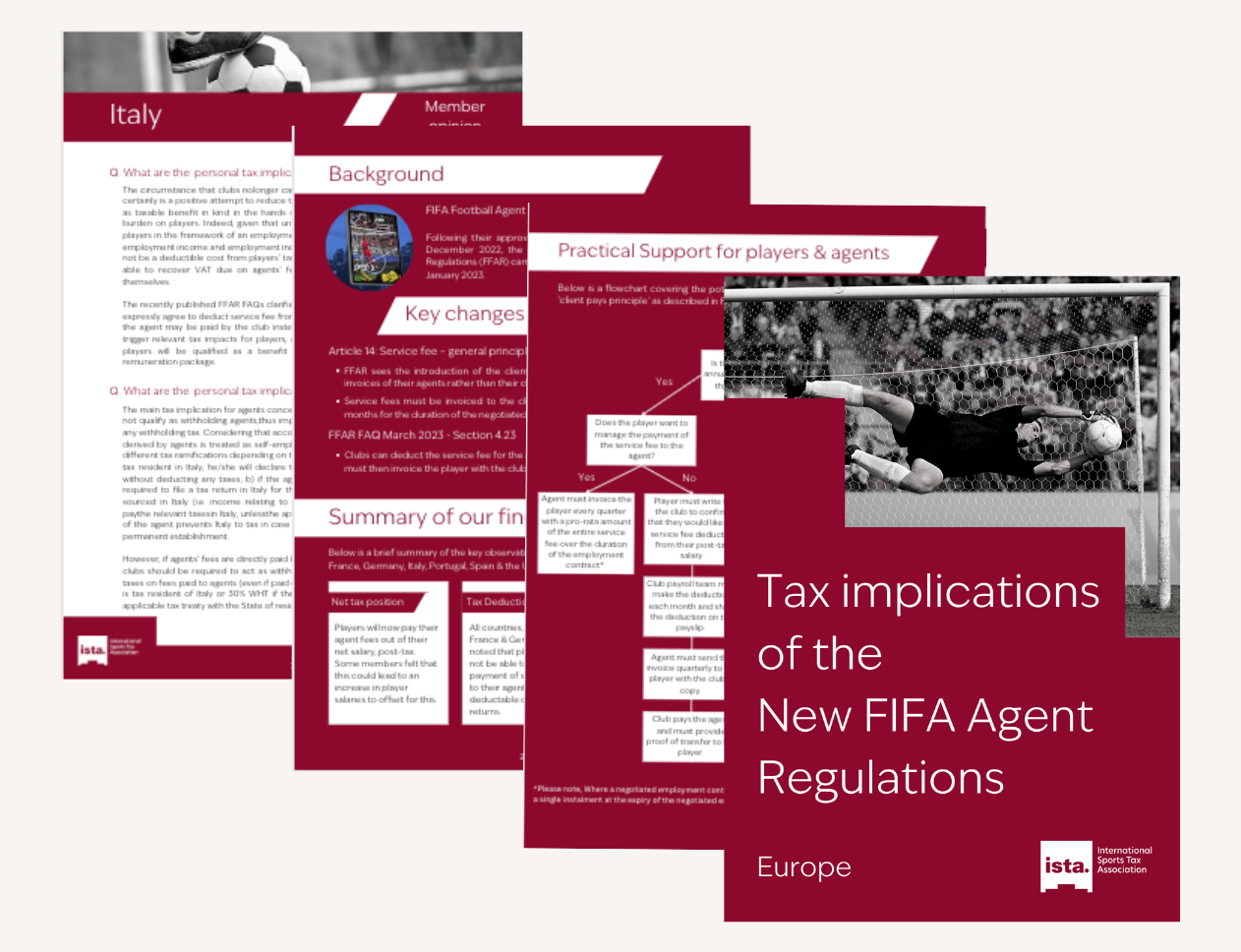

This resource, written by ISTA members, covers the tax implications of the FFAR in France, Germany, Italy, Portugal, Spain and the United Kingdom. The resource provides an overview of the key changes across Europe along with the full Member opinions from each country.

With the FFAR set to transform the world of football agency and bring about significant changes in the way agents operate, ISTA has created this comprehensive resource to help its members and associates navigate the tax implications of the new regulations for players and clubs in the major European leagues.

ISTA would like to take the opportunity to thank the contributors for this resource in order of country below:

France: Virginie Davion, Joffe and Associes

Germany: Christian Schmidt, Rechts- und Steuerberatung Schmidt

Italy: Alberto Brazzolotto, Maisto e Associati

Portugal: Bruno Arez Martins, Eversheds Sutherland FCB

Spain: Felipe Castillo, Muñoz Y Arias

United Kingdom: Sofia Thomas, Juno Sports Tax

Download a copy of Tax Implications of the New FIFA Agent Regulations: Europe

For press enquiries, please contact memberships@sportstax.org.

The Latest

Creel, García-Cuéllar, Aiza y Enríquez joins International Sports Tax Association as Partner Firm for Mexico

Tax Impact of the Premier League Report Released

The International Sports Tax Association (ISTA), in collaboration with football finance expert Kieran Maguire, today publish a comprehensive analysis of the tax impact of the Premier League.Ciarán Medlar and Sofia Thomas present at UEFA Grow Conference

Tom Wallace featured in the Daily Express on Luke Littler

ISTA celebrates our first year as an association

Overview of 2023 activities in the first year of the International Sports Tax Association.